Two Theoretical Markets

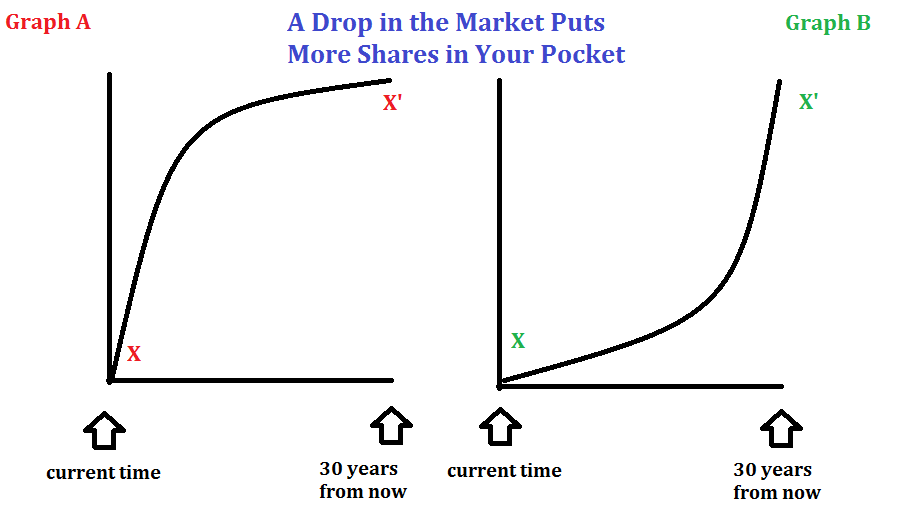

Which of these two markets would you rather be investing into consistently over long periods of time? Real world markets do not move in the manner displayed in the image above. In reality, they fluctuate. These two graphs are oversimplications used to make a point about how to think like a long-term investor.

Pretend that both graphs A and B represent the very same theoretical market (i.e. the US total stock market for instance) that reaches the exact same level (i.e. price) after 30 years, but the two markets take very different paths to get to that same destination. One market looks and feels better to most people because of amazing early returns. The other actually is better for anyone wishing to consistently and periodically buy assets (stocks, bonds, real estate investments, etc.) in the market in predetermined amounts and hold for very long periods of time.

It’s easy for an an investor to feel incredibly excited about getting early results like those in graph A. 30% or 50% annual gains would likely make anyone quite thrilled about their past investments within this market which have appreciated nicely. I feel conflicted though. It’s great for the past investments. However, it’s bad for any additional money I now plan to invest in the future since prices are now substantially higher.

The Calculus of Investing

If you plan to be continuously investing money you save, then you actually prefer a market that minimizes the area under the curve (a graph more like graph B) as that allows you to acquire more shares than a market which would be a straight line or a market more like the one depicted in graph A. You actually want to see slow growth or drops in prices as this allows you to buy more shares using the same amount of money. From personal experience, it’s very painful watching my investment portfolio as prices are dropping on stocks that I’ve purchased, however, personal experience also reminds me not to allow that pain to second guess my strategies as a long-term investor.

Fear Is the Mind Killer

Long-term investors typically have significant mastery over their fears and desires. Mastery over their fears allows those investors to keep buying even when all the news is bad and that the world might seem like it’s falling apart. On the other hand, investors who haven’t learned a way to put aside their fears have the tendency to give away their assets at a fraction of the price they paid when they choose to sell at the wrong time. Mastery over desires allows long-term investors to avoid getting swept up in euphoria so that they don’t buy assets at the wrong time when everything looks very rosy. Those long-term investors might still buy some assets during such economic boom times, but this is done at a more cautious pace than they would otherwise. More importantly, mastery over desires is an essential skill most successful investors possess. Long-term investors recognize that human desires don’t have boundaries, but their incomes is fixed or bounded. Thus, they choose to sacrifice some of their desires and set aside money toward their investments.

So here’s me raising a glass toasting to the next downturn (whenever that may be). For those of us who are young or middle aged, it’s an opportunity to buy more shares of good companies at lower prices. For those near or in retirement, it’s my hope your assets are positioned appropriately and you get the opportunity to periodically rebalance your investment portfolio (such as selling bonds to buy more stocks once stock prices become more fairly priced). Yes, the next downturn is not to be feared; it’s something long-term investors are looking forward to. May you plan accordingly and when you reach the final stages of your wealth accumulation, I hope you would be able to say, “I have more shares in my pocket” due to good planning and discipline.

“You don’t know if it’s fear or desire” – U2, So Cruel

“Some say the world will end in fire. Some say in ice. From what I’ve tasted of desire, I hold with those who favor fire.” – Robert Frost