The second and third quarters in 2017 were very busy in my household. We traveled to D.C. and Philadelphia, explored and started a couple new business adventures, completed a real estate transaction and volunteered our time at various community organizations. I completed my training to volunteer for FLCCT (Financial Literacy Coalition of Central Texas).

We read some great books, many which were recommended by friends and mentors (open to your recommendations as well). We attended several gatherings with the Austin Area Mustachians Facebook group and met so many like-minded awesome individuals. All in all, my family and I have been connecting with a lot of people through various avenues. I’ve also been going through a spiritual awakening. On my wife’s blog, Ms. Financial Literacy, she documented more of these events, such as here and here.

Today on my blog, I’m providing an update to our scoreboard. When our scoreboard is moving toward an upward direction, I like to reference to it as a snowball.

You may wonder why I chose a photo of a peacock as the featured image for this article. What does a peacock have to do with a scoreboard or snowball?

The peacock is symbolic in nature for me. I believe money itself buys little. The absolute best thing money can buy in this life is the freedom from having to worry about money (aka financial security). There are those who do not share my opinion and are constantly choosing to spend their money on all manners of status symbols, displaying their wealth to others like the creature shown above (as it was trying to attract a mate). Ironically, this behavior tends to actually result in less wealth.

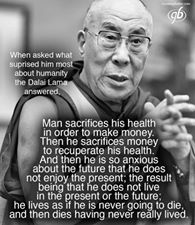

On September 8th, 2017, I made the ultimate luxury purchase — I retired. I bought back my own time. I avoided falling victim to the “one more year syndrome” that many planning early retirees can get caught in. My time can always be traded for more money (if need be). However, no sum of money has be used to buy back time that has already gone past. My reason for retiring right now can be summed up fairly well by this image.

Over the last 123 days, our snowball has grown from $1,584,000 (May 16th 2017) to $1,691,000 (September 16th 2017). From hereon, I don’t expect our snowball to grow at this rate. In fact, it will likely begin declining as both my wife and I are now retired from our W-2 employment.

This $107,000 increase represented both savings and market gains on investments. Since we don’t (and do not like to) budget in my household, I cannot say precisely how much of this gain was due to savings. However, I can say with confidence that the proportion from savings was around 30%.

Investment gains were responsible for approximately 70%. Expressed as a percent, this is a 4.75% gain over the last 4 months! A 4.75% gain every four months would result in a 15% gain (not 14%) for the year, which would be stellar. Yes, compound interest is magic.

As an investor, don’t expect those kind of returns all the time. You take the good with the bad. I’m impressed by our returns given that a small amount of our investment balance is in cash and another 25% are in bonds which historically don’t have as high of a return (compared to stocks). If you’d like to read more about my personal asset allocation, see my article here. However, my investment mix has changed a bit lately as we reallocated in August 2017. Our previous reallocation was in August 2016.

Throughout this year, many market analysts and participants felt stock prices were high. During such speculations, many might have been tempted to pull significant portions of their investments in stocks and move to cash (or to bonds). World events and particularly concern over North Korea caused some relatively mild turbulence in the market, but the market just kept on climbing. I’m so glad I was not among those investors who fell victim to worry or temptation. While North Korea in general does have me very worried, I do not allow this matter to have any impact on my investing strategies.

In my typical fashion, I did nothing, which is my favorite thing to do. Or rather, I just did more of the same. I stayed on course. I kept investing new savings to maintain my stated asset allocation. It’s what I did last month, last year, and many years before. I plan to do the same next month, next year, and the years following. The only time I might deviate from this is if the market would to experience some significant turbulence. In that case, I’d do more of what i did in 2008 and 2009.

Enough about our snowball, let’s get yours rolling! I’d love to hear from you in the comment section below. Please post any financial questions you can think of here for me to answer.

Have any questions for me regarding my retirement?